|

Meeting Local Financing Needs

Deposits and Loans

The Bank operates mainly in Wakayama and Osaka prefectures, with 67 branches in Wakayama and 32 branches in Osaka.

In Wakayama Prefecture, the Bank commands the largest market share for both deposits and loans, and recognizes that its role as the leading bank in the region is more important than ever before.

Lending to small and medium-sized businesses and private customers

After the merger of Kiyo Bank and Wakayama Bank in October 2006, the balance of loans to small and medium-sized businesses began to increase, thanks to initiatives such as the introduction of loans with neither collateral security nor third-party guarantees. After the merger of Kiyo Bank and Wakayama Bank in October 2006, the balance of loans to small and medium-sized businesses began to increase, thanks to initiatives such as the introduction of loans with neither collateral security nor third-party guarantees.

The balance of loans to small and medium-sized businesses as of March 2007 was ¥941.8 billion, up ¥4.6 billion from the previous year.

Loans extended to small and medium-sized businesses and retail banking customers (individuals) in the region amounted to ¥1,623.2 billion, or 77% of the total loan balance of ¥2,111.4 billion. Loans extended to small and medium-sized businesses and retail banking customers (individuals) in the region amounted to ¥1,623.2 billion, or 77% of the total loan balance of ¥2,111.4 billion.

Assets under Custody

The balance of assets under custody, including investment trusts, personal pension insurance, and Japanese Government Bonds issued solely for individuals, has shown a steady increasing trend over the past few years. The balance of assets under custody, including investment trusts, personal pension insurance, and Japanese Government Bonds issued solely for individuals, has shown a steady increasing trend over the past few years.

Initiatives for the Invigoration of the Regional Economy

Smooth Funding Smooth Funding

Utilizing a scoring model and our own internal ratings, we expanded our line-up of readily available loans with neither collateral security nor third-party guarantees to include new business loan products for both corporate customers and sole proprietorships in the region, as well as other products with ORIX Corporation.

Management Advice and Consulting

The Bank makes proposals and provides information to solve its corporate customers’ management problems and meet their other requirements.

Using its network of university, industry and government partners, the Bank also provides its customers with support for new business startups and expansion into new business areas.

Support for Management Improvement

Through collaboration between the management support section of the Credit Division and the sales offices, and in close communication with its customers, the Bank provides assistance with the formulation of optimum management improvement plans, and also verifies the present conditions and offers advice whenever necessary.

In the fiscal year ended March 2007, reflecting improvement in customers’ financial positions, the debtor categories of 20 companies were upgraded.

In some cases the Bank is involved in the realization of business reconstruction plans in collaboration with outside bodies such as the RCC (Resolution and Collection Corporation) and other governmental bodies. In other cases, it is involved in fundamental reconstruction using a variety of methods such as a reconstruction fund, co-financed by Kiyo Bank, for troubled companies in the region.

Topics — Making Our Services More Convenient and More Secure

Opening of Internet Branch Opening of Internet Branch

In June 2007, the Bank opened an Internet branch on its website.

Although new account applications must be sent by conventional mail, customers who already have accounts with us can now make a term deposit application online 24 hours a day, 365 days a year, eliminating the need to visit their local branch.

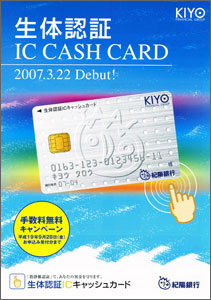

Biometric IC Bank Card

To prevent unauthorized withdrawals using counterfeit or stolen bank cards, the Bank launched a biometric IC bank card employing finger vein authentication in March 2007.

|